illinois payroll withholding calculator

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. Illinois Hourly Paycheck Calculator.

15 Price List Templates For Small Business Templateinn List Template Quotation Format Price List Template

This is a projection based on information you provide.

. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Illinois Payroll Withholding Effective January 1 2022. Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay Illinois withholding income tax payments are made on Form IL-501 Withholding.

Deducts the child support withholding from the employees wages. Use ADPs Illinois Paycheck Calculator to calculate net take home pay for either hourly or salary employment. This is a projection based on information.

Illinois State Disbursement Unit PO. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

Instead you fill out Steps 2 3 and 4. Typically the wage base is usually 12 960 regarding 2021 and costs range from zero. This Illinois bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

62 of each of. Supports hourly salary income and multiple pay frequencies. This calculator is a tool to estimate how much federal income tax will be withheld.

Get Started With ADP. Ad Process Payroll Faster Easier With ADP Payroll. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

If the income is paid biweekly multiply the minimum wage times 60 60 x 825 495. Free Federal and Illinois Paycheck. Just enter in the required info below such as wage.

Calculates Federal FICA Medicare and. Free Illinois Payroll Calculator. For Medicare insurance tax withhold 1.

45 of each and every employees taxable. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. Discover ADP For Payroll Benefits Time Talent HR More.

Discover ADP For Payroll Benefits Time Talent HR More. Illinois Hourly Payroll Calculator. Use smartassets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Ad Process Payroll Faster Easier With ADP Payroll. Youll use your employees IL-W-4 to calculate how much to. Youre not the only business owner in Illinois poring over payroll taxes for your hourly employees.

2022 Federal Tax Withholding Calculator. Illinois Payroll Withholding Effective January 1 2022. Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use.

Free Federal and Illinois Paycheck Withholding Calculator. All amounts are annual unless otherwise noted. Get Started With ADP.

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income. 2022 Federal Tax Withholding Calculator 2022 Federal Tax Withholding Calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. If would like to change your current withholding please complete a new W-4P and send it to the. Box 5400 Carol Stream IL 60197-5400.

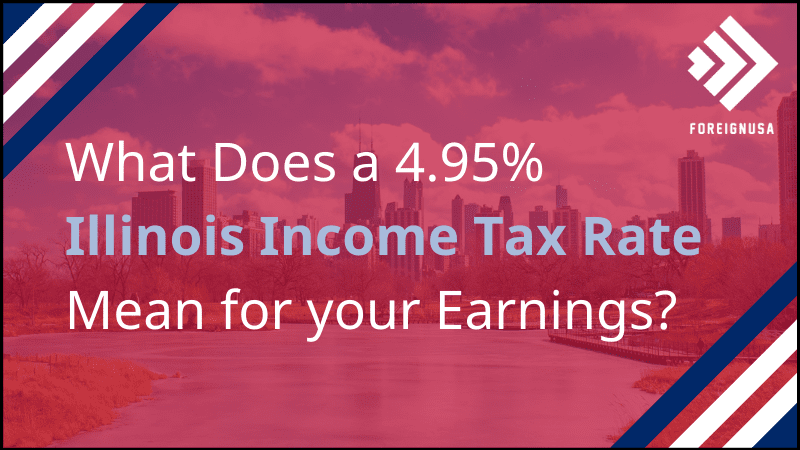

Additional payroll withholding resources. This free easy to use payroll calculator will calculate your take home pay. Illinois Withholding Tax Tables Illinois Income Tax withholding at 495 percent 0495 Based on allowances claimed on Form IL-W-4 Illinois Withholding Allowance Certificate Daily Payroll.

Illinois Minimum Wage 2022 Increase Eder Casella Co Certified Public Accountants

Where S My Illinois State Tax Refund Taxact Blog

Should My Long Term Disability Benefits Be Taxed I

Solved Illinois Schedule Cr Credit For Taxes Paid To Ot

The Caucus Blog Of The Illinois House Republicans Calculating Estimated State Taxes During Covid 19 Pandemic

Calculating Withholdings When Hiring Workers

What Is A Fair Tax For Illinois Seiu Local 73

Employee S Payroll Software Payroll Payroll Taxes

Illinois Paycheck Calculator Smartasset

Payreq Is A Global Specialist In Securely Connecting Employers Billers And Mailers To Digital Document Delivery Platforms イデコ 証券 控除

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

Illinois Minimum Wage Increasing In January Eder Casella Co Certified Public Accountants

A Visual Representation Of How To Do Your Payroll Taxes Infographic Payroll Taxes Payroll Personal Finance

The Illinois Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings